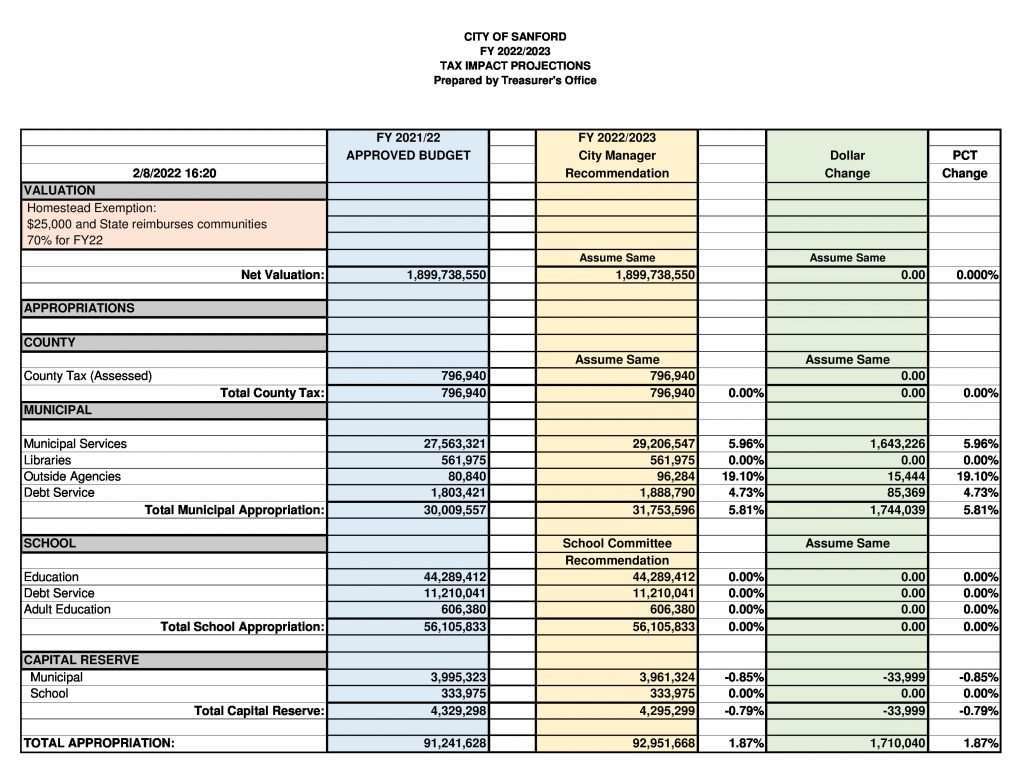

Council Gets First Look at 2022/23 City Budget

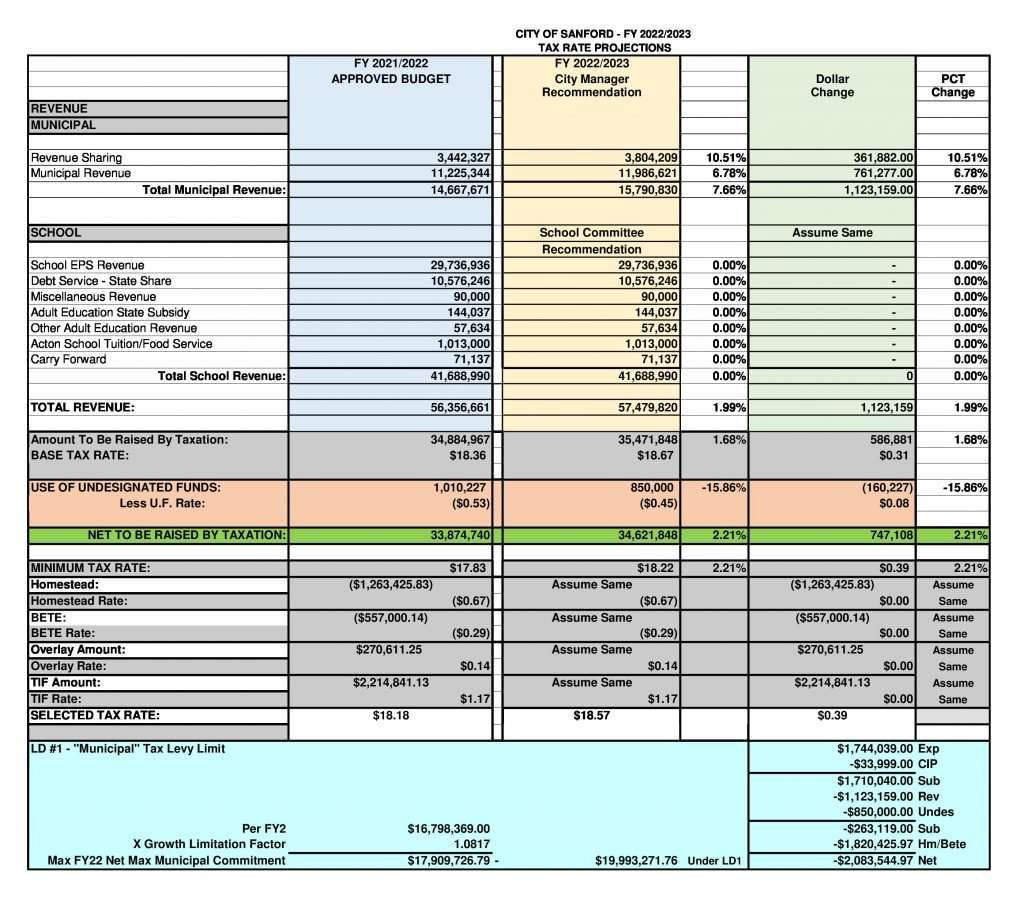

On Tuesday, February 15, the City Council got its first look at the proposed 2022/2023 municipal budget when City Manager Steve Buck gave an overview of the numbers. The end result is a 2.21% increase in net taxation, but he feels that is high at this point and expects it to come down as final numbers for revenue sharing are released by the state in mid-March.

He began by saying that the city’s property valuation is not done yet, so the budget reflects the same valuation as last year. City Assessor George Greene believes it is too early to speculate where the valuation will end up, but Mr. Buck estimates at least a $150 million increase. (By comparison, last year’s valuation increased by $200 million over the previous year.) However, he expects more of an increase in multi-family and commercial property assessments than last year, to balance the burden on single family homeowners.

County taxes are expected to remain the same as the past several years, in part due to the fact that coastal communities in York County have seen an even greater rise in valuation than Sanford/Springvale – meaning they will bear the brunt of any increase in County taxes.

Expenses

The overall budget shows an increase in expenses of $1.64 million, or 5.96% over the current year’s budget. The major contributors to the increase are:

- Full-time salaries – $1,008,536 which includes cost of living increases in labor contracts as well as several new positions. Among these are:

- A new equipment operator position to be split between the Parks Department in the summer, and the Public Works Department in the winter

- Two dispatchers, to be paid with American Rescue Plan Act (ARPA) funds

- A second Assistant Fire Chief to focus on EMS operations and training. This is in lieu of two firefighter/paramedic positions that were requested

- Deputy Director of Operations for the dispatch center to be trained in management and be responsible for the training of new dispatchers

- A new police officer, partly paid through the federal COPS grant

- New social worker for the Police Department, paid through ARPA

- A new position of Assistant Public Works Department Director, replacing the former Highway Foreman position

- Benefits and insurance – $308,536, which Mr. Buck said is not an unusual increase

- Supplies – $104,070. Costs for paper and other items are way up. The Police Department’s request for supplies includes increases in ammunition, PPE and items for the new social worker in the Mental Health Unit

- Non-contract services – $75,134 including marketing, title searches for the Clerk’s office, and pre-employment physicals for the Fire Department

- Part-time salaries – $52,499, largely driven by additions to Parks and Rec staff, as full programming is expected to be restored and some new programming may be added this summer. Much of this is offset by revenue. A part-time human resources person to help with additional hiring and a seasonal cemetery worker are also included here.

- Debt service is increasing by $85,369. This is mostly due to a new proposal by the Planning Department for a 10-year brownfields bond to address the International Woolen Mill boiler house, which was recently declared by the Council to be a dangerous building. The bond would have to be approved by voter referendum. A 5-year bond for the Presidential Lane extension at the Airport will be offset by increased revenues there.

Expenses for the City’s two libraries are being held at the same amount as the current year.

The amount for outside agencies is going up due to a request by York County Community Action for an addition to its transportation budget. Mr. Buck said a YCCAC representative will make a presentation on that $35,000 request at an upcoming Council meeting.

Some expenses are actually significantly down this year, including the Overtime budget, which has been drastically reduced in the dispatch center with the addition of new full-time employees. The line item for gasoline and diesel was reduced in part due to a review of historical gas use by the Police Department.

Mr. Buck commended the City’s department managers for their work to keep budget requests down this year.

The Capital Reserve budget is requested at $3.96 million this year, a decrease of .8% over the current fiscal year. (We will have a separate article detailing those requests next week.)

Revenue

Mr. Buck said an increase of 10.51% in municipal revenue sharing is forecast, but he thinks that is under-projected. Exact numbers are not available yet, but he said the state economy is doing very well, better than projections. As soon as numbers are available from the state, he expects at least another $200,000 in revenue to increase this line item.

Other municipal revenues are expected to rise 6.78%, due to big increases in ambulance fees being collected, and in dispatch services provided to other communities. Building permits and planning fees are up due to the rapid pace of construction and development activities. Excise tax is flat this year due to the shortage of new vehicles for purchase.

Mayor Anne-Marie Mastraccio said she believes the City’s reimbursement for the homestead exemption is gong to rise from 70% to 73%, bringing in additional revenue.

Council Comments

Councilors Becky Brink and Ayn Hanselmann and Mayor Mastraccio all advocated for additional police focus on traffic enforcement due to the number of complaints they receive from residents. Mr. Buck said he is waiting to see how much money the City will receive from the opioid settlement. He said those funds may be able to be used toward the social worker position for the Police Department, which would then free up ARPA funds that might fund a traffic officer. He will have a better idea on the settlement amount by the next Council meeting.

Councilor Bob Stackpole asked for a breakdown at a future meeting of all the positions that are being funded by ARPA. He is concerned about the possibility of a “fiscal cliff” when those federal monies are no longer available.

Councilor Jonathan Martell asked how the budget could be used to mitigate the annual recurring problem of potholes, which is a big topic of complaint on social media. Mr. Buck replied that by staying the course on the Capital Improvements Plan for road reconstruction, the City will gradually get to a PCI (pavement condition index) of 85 or greater, at which point maintenance needs will significantly drop. At only three years into the program, our roads are not there yet. He said this year the rapid freezing and thawing is doing more damage than usual.

The Bottom Line (for now)

Proposed municipal expenses come in at $31,753,596 plus capital reserve of $3,961,324. These are offset by revenue projected at this time of $15,790,830, and use of $850,000 in undesignated funds.

The combined municipal and school budget Mr. Buck presented to the Council shows a total of $34,621,848 to be raised from taxes, which is an increase of $747,108, or 2.21% over the current year’s budget. But the numbers are far from final and both budgets have many more steps to go through before they are approved. See the budget as presented below.

The Budget Committee will review the budgets on Thursday evenings in March. There will be opportunity for public comment at each meeting, and a combined public hearing on both school and municipal budgets is scheduled for March 17.