Budget Committee Hears Details of Proposed City Budget

Municipal Revenue Sharing from the State Expected to Rise Sharply

The City’s Budget Committee met for the first time this year on March 3, 2022. The Committee includes four citizen members – Wesley Davie, who was elected Chair; Aimee Garneau, elected Vice Chair; Lindsay Quinn, elected Secretary; and Melissa Alipalo. Deputy Mayor Maura Herlihy and City Councilors Robert Stackpole and Ayn Hanselmann are also members.

City Manager Steve Buck presented his recommended 2022-23 budget, which he presented to the City Council on February 15. See that story for details.

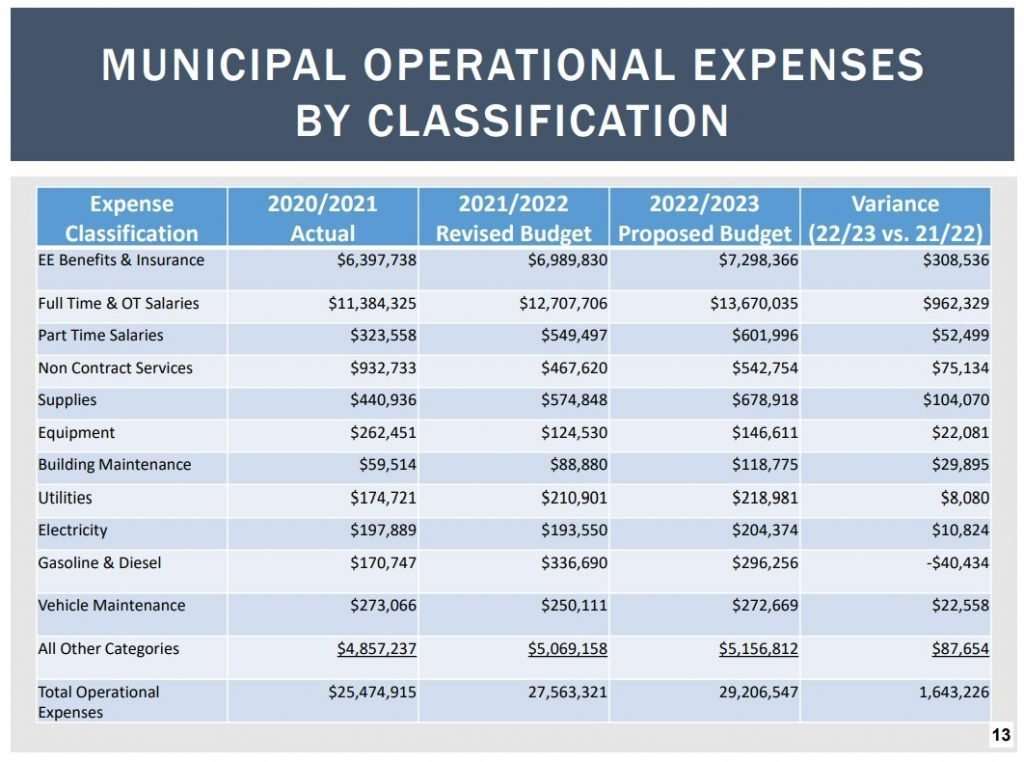

Expenses

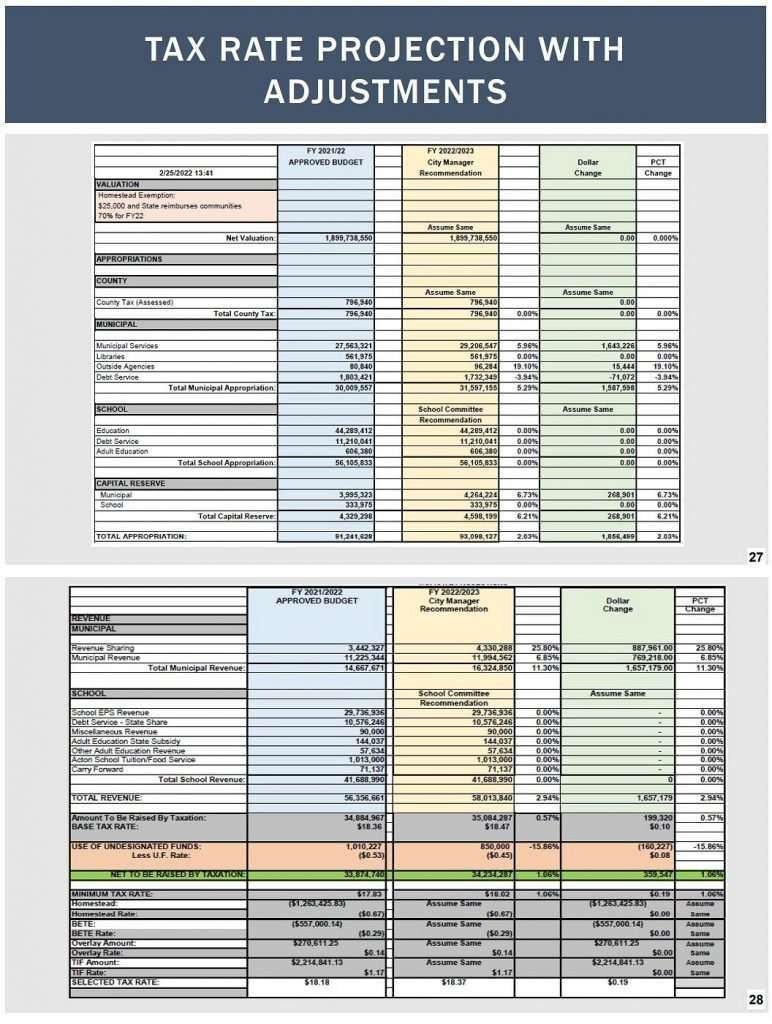

On the expense side of the budget, the numbers for Municipal Services (which includes all city operations), Libraries and Outside Agencies were the same as presented to the City Council last month, but the amount for Debt Service decreased slightly. Mr. Buck went into more detail on each of the Department requests. 71.7% of the City’s operational expenses are for full-time salaries (with contracted increases), benefits and health insurance.

Several new positions were proposed by department heads, but not funded in the recommended budget. One of these was a Planning Tech position for the Planning Department. Mr. Buck said instead they will increase the salary of the Planner position, which has been vacant for months, to attract a more experienced candidate who can ultimately succeed the Planning Director when she retires.

A new Civil Engineer position for Public Works has been in discussion for at least five years, but Mr. Buck said that was removed in lieu of other priorities. A Sign Shop/Traffic Foreman has been requested for the past three years, but that position will instead be absorbed in the reorganization of that department.

While the proposed expense side of the budget is well detailed, the revenue side is still awaiting further information from the state before final figures can be calculated.

Revenue

Revenue the City receives is broken down into two categories, Municipal Revenue -which includes things like ambulance fees, excise taxes and airport revenue – and Municipal Revenue Sharing (MRS), which is the amount of money each city and town receives from state-collected sales and income taxes.

Municipal Revenue: At this time, Mr. Buck is projecting an increase of 6.85%, slightly more than the number he presented to the City Council in February. Most of that increase is from federal American Rescue Plan Act Funds, but ambulance fees, dispatch fees, recreation fees, airport revenue and building permits are all projected to be up substantially from the current year’s budget. Investment income is projected to decrease by $125,000, and debt service reimbursement is also dropping, due to the decrease in the amount of debt service on the expense side of the budget.

MRS: For the 2021-22 fiscal year, which we are in now, 4.5% of state revenues were shared with cities and towns. For 2022-23, that figure is expected to return to 5%. The actual amount of money Sanford receives depends on what the state projects its revenues will be. Reports from the Governor’s office seem to indicate the state expects revenues to increase substantially. The state will release updated numbers March 15, and the final state budget will be enacted July 1. In developing the proposed municipal budget, Mr. Buck initially used a projected increase of 10.51%, but based on recent forecasts, now expects Sanford’s share to increase by 25.8%, or $526,079.

If those numbers are accurate, Mr. Buck is proposing to use more than half of that increase for two capital reserve projects. He would like to return $250,000 that was cut from the road construction line item, and budget $52,900 for the City Hall cooling tower replacement that was discussed at last week’s City Council meeting. The balance of $223,179 would be used to offset net taxation.

The City’s property assessment is also still not finalized. The assessment determines how the tax burden is spread among the various categories of property. Last year, single family homeowners had the largest tax increase, due to the rise in home valuations, while some multi-family and business property owners actually saw their taxes go down. While property values have risen again in the past year, the new assessment is expected to spread the burden more fairly among property types. Mr. Buck said he would be meeting with Assessor George Greene the following day, so he may have more information by the next Budget Committee meeting on March 10, but assessments are not finalized until April 1.

The Bottom Line (For Now)

Proposed municipal expenses come in at $31,597,155 plus capital reserve of $4,264,224. See this story on proposed capital reserve projects. Expenses are offset by the latest revenue projections of $16,324,850, and use of $850,000 in undesignated funds.

The combined municipal and school budget Mr. Buck presented to the Council shows a total of $34,234,287 to be raised from taxes, which is an increase of 1.06% over the current year’s budget. He had initially projected a 2.21% increase. But, with the assessment and municipal revenue sharing numbers still up in the air, these figures are expected to be updated before the budget is approved. See the latest tax projections below.

The Budget Committee will have the opportunity to recommend adjustments on the expense side of the budget. The City Council will have the final say on the municipal budget, while the school budget goes to voter referendum in June.

The Budget Committee will hear Superintendent of Schools Matt Nelson’s presentation of the proposed 2022-23 School Department Budget on March 10. A public hearing on both the municipal and school budgets is scheduled for March 17, but there is time set aside for public input at all Budget Committee meetings. (No members of the public spoke at this first meeting.) The Committee will then have a few weeks to discuss and vote on the budget before presenting its recommendation to the City Council on April 5.

Mr. Buck’s complete PowerPoint presentation and background information are included in the meeting packet here.

The full meeting video may be viewed here.

See our Events Calendar for links to upcoming meetings.