Council Approves Budgets for 2024/25 Tax Rate up $1.03

- April 7th 2024

- City CouncilCity News

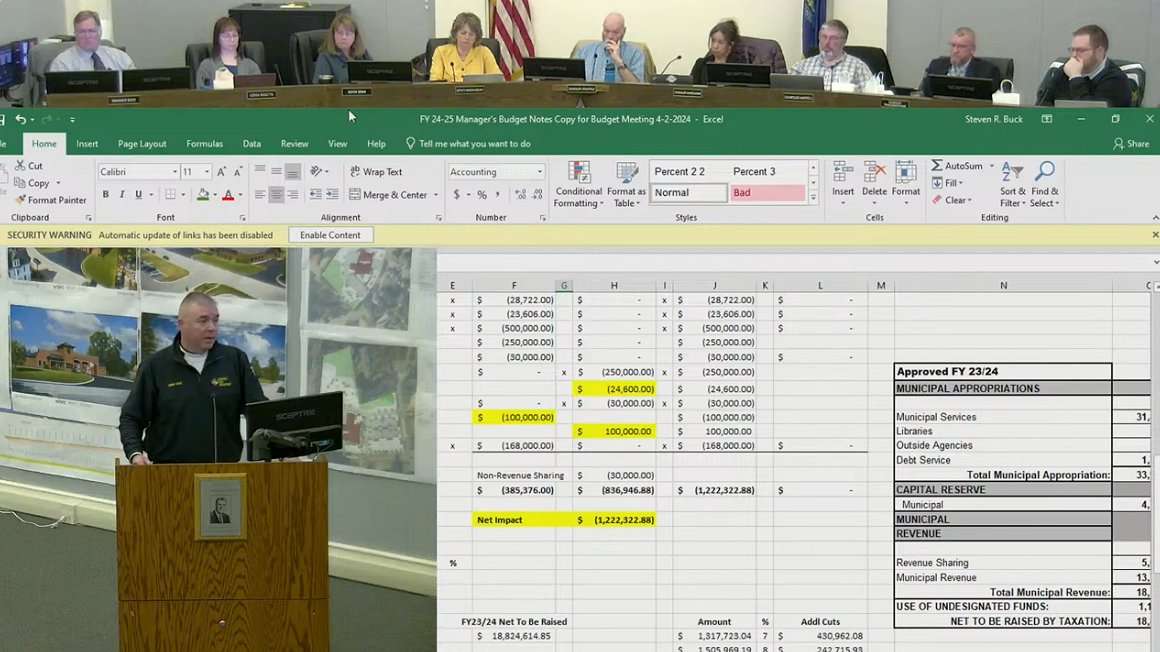

Sanford Fire Chief Scott Susi (at podium) answers questions from the City Council.

Source: WSSR-TV

By Zendelle Bouchard

At its regular meeting on April 2, the City Council approved the combined municipal and school budget for the fiscal year 2024/25, which begins July 1. That is the last word on the municipal side of the budget; the school budget must be validated by voters on June 11. The net to be raised by taxation is $39,142,006, an increase of 8.34% over the current fiscal year. (See below for more numbers.)

During a two-hour budget meeting before the regular meeting, there was lengthy discussion on the proposed new Community Paramedic (CP) position that has been in the planning for more than a year. The city has already been awarded a $100,000 grant to purchase a vehicle and equipment for the CP, but the state has now put off final approval on the law which will allow the city to bill insurance companies for CP visits, until a study on reimbursement rates can be completed. The position cannot be created and filled until that is done, which may not be this year. Councilors debated whether to go ahead and purchase the vehicle and equipment with the grant funds, as the money must be spent by June 30.

Ultimately six of the seven councilors agreed to go ahead with the purchase, after being assured by Fire Chief Scott Susi that the funding for the CP program has already been approved at the state level and “it’s bureaucracy now…DHHS just has to have their say.” If the program does fall through for some reason, the city would have to pay back the grant money, but the medical equipment could still be used by the Fire Department and the vehicle, which is the same model used by the Police Department, could be repurposed by the city in place of a regularly scheduled future capital purchase.

In the 2024/25 budget, the total municipal appropriation is increasing 10.69% and the school appropriation is increasing 5.41%. The combined capital reserve is decreasing by 4.02% and the county tax is estimated to increase 6.31%. Total combined appropriations are up 6.71%.

Revenues on the city side are increasing 7.64% and on the school side are up 4.63%, a combined total of 5.51% increase.

After adjustments for the homestead exemption, business equipment taxes, use of overlay and tax increment financing revenue, the bottom line is the projected tax rate will rise to $16.17, an increase of $1.03 per $1,000 of valuation. This represents an increase of 6.81% from the current fiscal year.

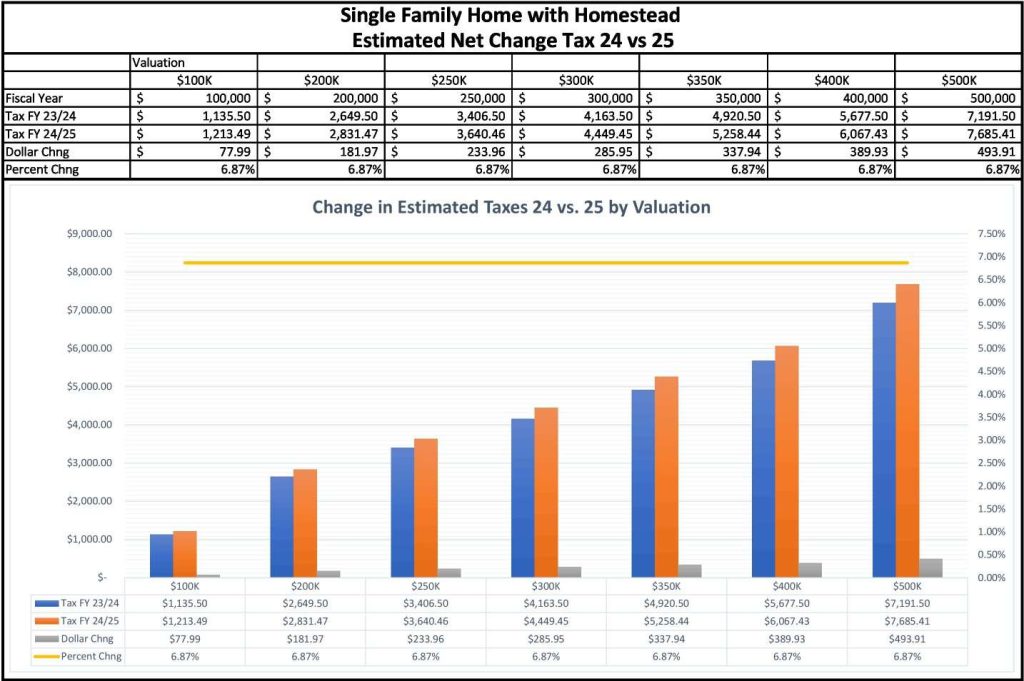

City Manager Steve Buck showed a graph detailing the impact to the average property tax bill for a single-family home with a homestead exemption, broken down by property values:

- A home assessed at $100,000 will see a total annual tax increase of $77.32

- A $200,000 home will have an annual increase of $180.42

- A home assessed at $250,000 will see an increase of $231.96

- The yearly tax bill for a $300,000 home will be up $283.51

- On a home assessed at $350,000, the tax bill will increase $335.06

- A home assessed at $400,000 will see an increase of $386.60

- A $500,000 home will have a $489.70 tax increase

Buck announced that Sanford/Springvale has a total real and personal property valuation of $2,479,090,440, which is an increase of $32,493,860 in new valuation over last year. This represents $525,456 in new tax revenue for the city.

The final budget vote was 4-3, with Councilors Bob Stackpole and Pete Tranchemontagne joining Mayor Becky Brink and Deputy Mayor Maura Herlihy voting in favor of approval. Brink said she was satisfied with the cuts that had been made from the initial budget recommendation. Herlihy added that it would be hard to go much lower without cutting significant positions from city staff. Tranchemontagne said he did not want to cut any more positions from either the city or the School Department.

Councilors Ayn Hanselmann, Jonathan Martell and Nate Hitchcock voted against approval. All three indicated they would like to see more cuts but did not offer any specific suggestions that got any traction during the budget discussions. Hitchcock said although he was voting against finalizing the budget numbers, “ultimately I would be OK with this percentage” if no more cuts could be found.

The video for the budget meeting may be viewed here: https://www.youtube.com/watch?v=gDAI2nbyd1Y

The regular City Council meeting video may be viewed here: https://www.youtube.com/watch?v=5q3LXXEHj5c