Municipal Budget Update

- March 29th 2024

- City News

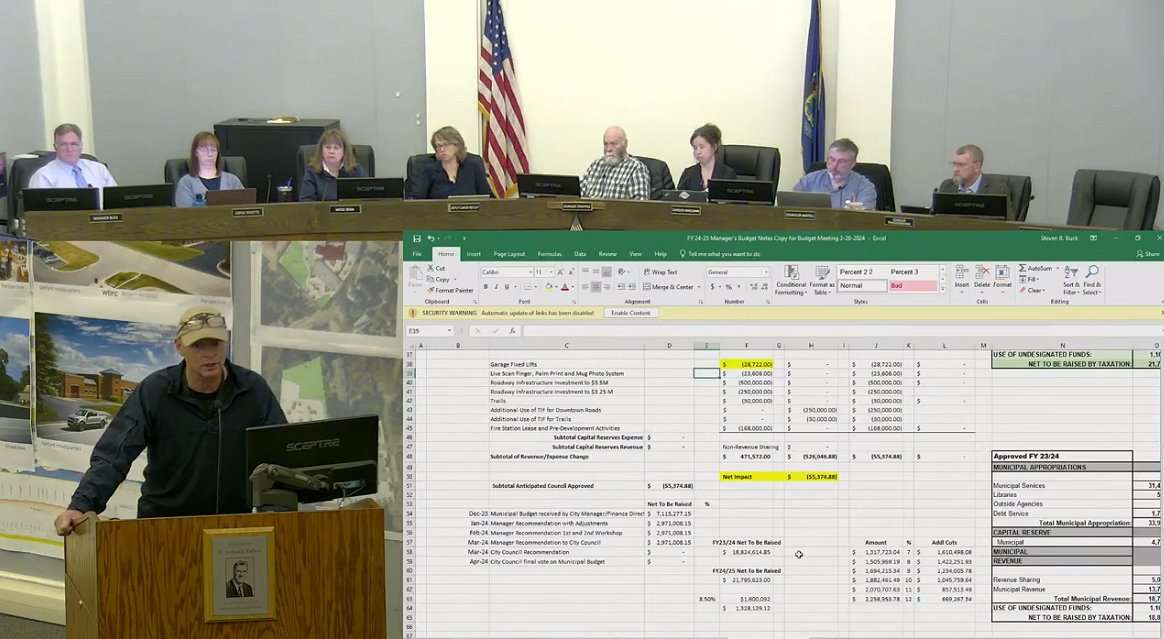

Police Chief Craig Andersen (at podium) addresses the Council.

By Zendelle Bouchard

The City Council continues to work on the budget for fiscal year 2024/25. On March 26, 2024, they met again to discuss possible further cuts and adjustments to a budget which will likely result in the largest property tax increase in more than ten years.

Sanford Police Department Chief Craig Andersen told the Council he currently has two vacant police officer positions and offered to use the salary from one of those positions to cover the cost of hiring a second social worker to the SPD’s Mental Health Unit. He said having a second social worker is a priority that could help prevent tragedies. The Councilors agreed that adding another social worker to cover the evening shift, when many crisis calls come in, would be valuable but had previously cut the funds that would pay for it from the budget. After hearing from the Chief, they agreed to make that adjustment. The social worker position is budgeted at about $11,000 less than the police officer position, so there is some savings as well.

There was lengthy discussion on a requested mobile digital fingerprinting system for the SPD, which Chief Andersen said would help the Department meet state requirements for getting prints into the state and national databases. Using the “old school” paper and ink process, the Department is out of compliance 70% of the time, he said. A digital scanning system would increase the compliance rate, and a mobile system would enable fingerprints to be scanned when people are summonsed for offenses that don’t require them to be brought to the police station. Currently, those offenders are on the honor system to come in and be fingerprinted, and many don’t. Ultimately, only two Councilors were in favor of buying the new system this year, so it will be put off for another year.

Under Public Works, the Council agreed to keep the roadway capital improvement plan at $3 million, the same as the current year. They had previously planned to increase it to $3.5 million next year to keep up with inflation and to continue improving the overall condition of Sanford’s roads, but decided it was too much of a jump with the budget already higher than they’d like. They also agreed with City Manager Steve Buck’s recommendation to use $250,000 from Tax Increment Financing revenues to help offset the $3 million road CIP.

The Council also approved a suggestion from Deputy Mayor Maura Herlihy to reallocate some Public Works Department equipment CIP funds to purchase a new garage lift, which will enable the PWD to service more of its fleet in-house. Councilor Pete Tranchemontagne agreed that it was a safety issue that would also save money in the long run.

There was discussion about using funds from the city’s undesignated fund balance. Councilor Ayn Hanselmann advocated for using almost $250,000 to cover one-time expenses, including a new roof and masonry work for the Veterans Memorial Gym. The majority of the Council supported the idea. Councilor Bob Stackpole asked if it was sustainable to consider doing that every year, but Buck said he did not recommend it to keep the city’s cash flow in a healthy position.

The Council also went over the latest list of open positions to see if there are any that could be eliminated but couldn’t come to agreement on any that were dispensable. Human Resources Director Stacy Howes said although historically there have been challenges in filling the Equipment Operator I positions at Public Works, there has been an uptick in applications recently. Thanks to the commercial drivers’ license training and incentive bonuses the city now offers, she is optimistic all the positions could be filled this year. There is regular turnover in those jobs as the city hires from within to fill EO3 and EO4 positions.

There has been a vacancy for a Code Enforcement Officer for several years, but Planning and Codes Director Jamie Cole said he would instead like to hire an administrative assistant to help with the paperwork that is bogging him down, leaving the Code Enforcement Officers to handle the inspection work.

After the adjustments the Council agreed to, the net-to-taxation increase came to 8.3% (combined municipal and school). If the state agrees to reimburse the city 90% on general assistance benefits, that would add $190,000 to the revenue side, and bring the increase down to 7.78%, which means a 98-cent increase in the property tax rate per $1,000 of valuation.